The United Way Building of Washtenaw County in Ann Arbor, Michigan

Torrence Williams | Washtenaw Voice

by HEIDE OTTO

Contributor

The IRS announced the 2020 tax year return deadline had been extended for individuals until May 17, 2021.

Monies owed for 2020 Federal taxes have also been extended until May 17th. No additional forms need to be filed to take advantage of this automatic extension.

Luis Garcia, IRS media relations, verified recent changes, provided money-saving tips and scam prevention for tax filers.

To avoid penalties and interest, Garcia recommends doing a rough estimate of money owed and paying by May 17, even if you file for an extension until October 15, 2021.

“If you give the IRS too much, you will get a refund. If you owe, you won’t owe as much,” Garcia said.

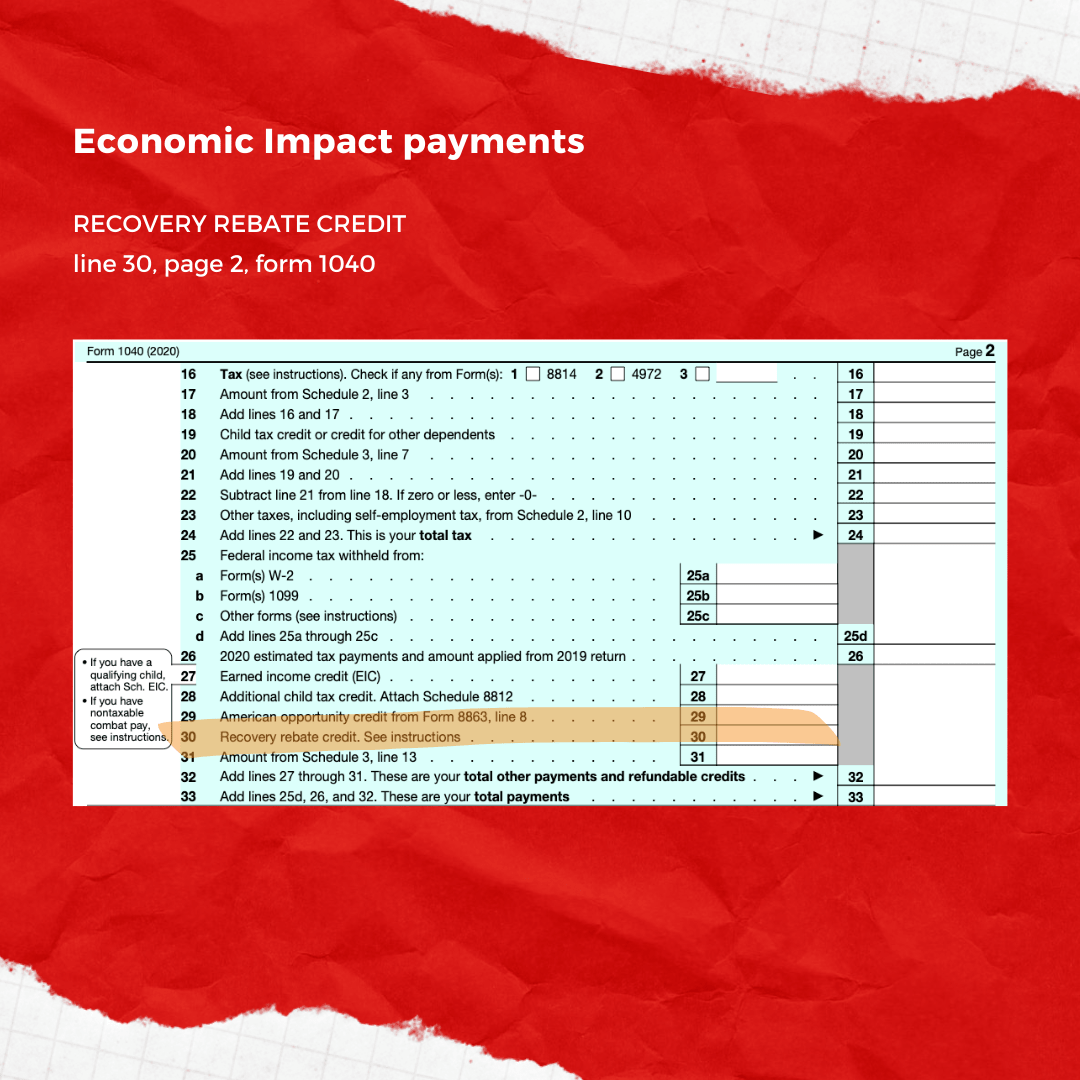

Economic impact payments

A taxpayer that files as non-dependent can receive the Recovery Rebate Credit, provided stimulus checks have not been received. This gives taxpayers a tool to receive missing CARES act stimulus funds through the 2020 Federal return.

For dependents, the economic impact payment goes to the primary filer.

“You need to look at your return, to see if they [the tax preparer] had claimed Recovery Rebate Credit,” Garcia said.

The American Rescue plan was passed in 2021. Stimulus payments from this plan are not included in the 2020 tax return.

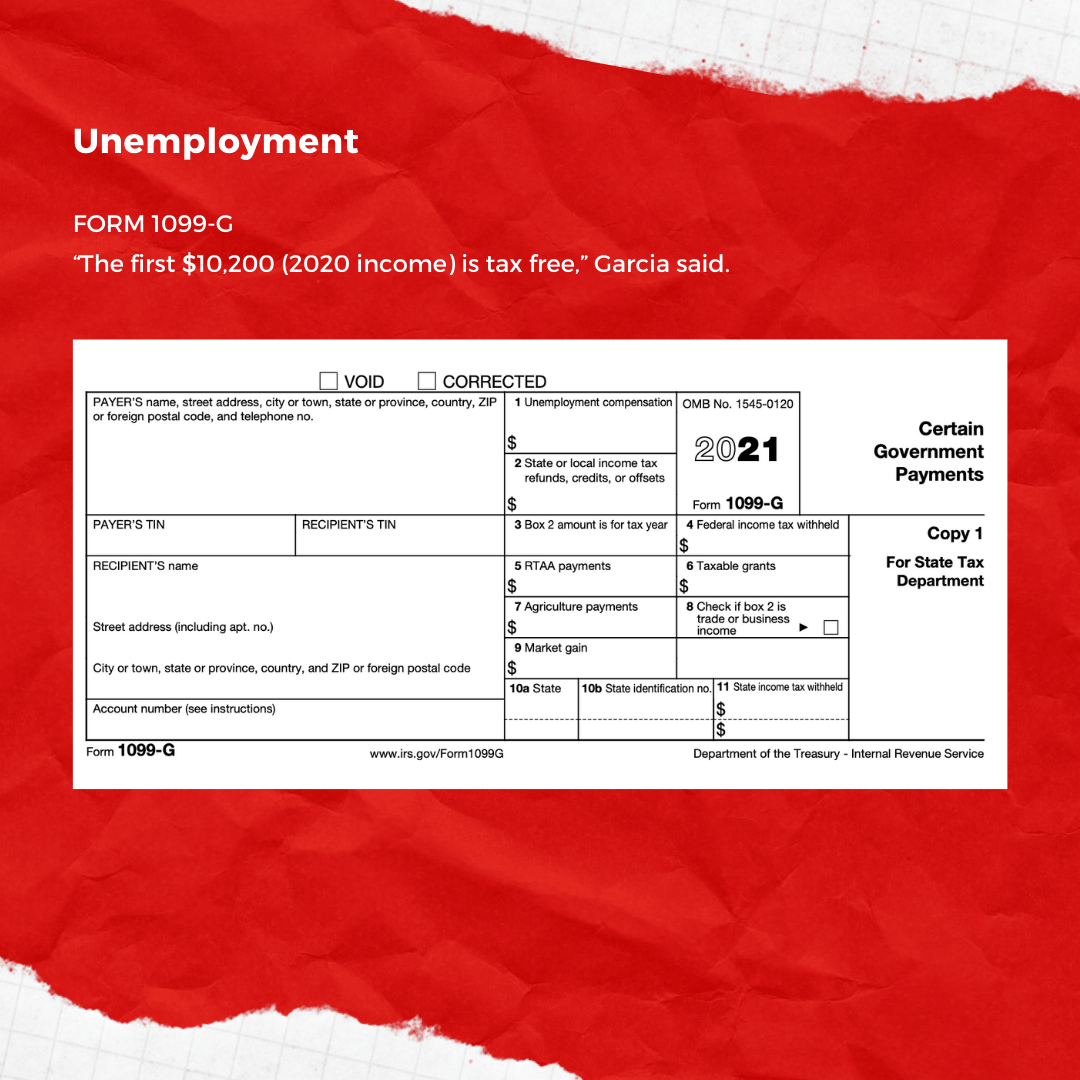

Unemployment

The first $10,200 (2020 income) is tax-free, according to Garcia.

“In the future, it is important that you properly withhold from your unemployment check.

“If you under withhold, you may be looking at a tax bill you were not expecting,” Garcia said.

If you are getting $100, “there are three taxes that you have to pay: Federal Income, Social Security which is seven and a half percent, and Medicare/Medicaid which is seven and a half percent. For $100 per week you should withhold $30,” Garcia said.

“If you don’t withhold the right amount, when it becomes tax time, it really adds up and you have to pay it back,” Garcia said.

Garcia advises to use the calculation sheet that goes with the W-4 for unemployment withholding.

“If you do it properly, you won’t have a problem at tax time,” Garcia said.

Free tax help

“We have partnered with United Way. The VITA (Volunteer Income Tax Assistance) program is vital,” Garcia said.

VITA has IRS trained and certified volunteers that will do taxes for free for those making $52,000 or less, according to Garcia.

Free Federal software

“The free file program is different. It is software from nine different software companies,” Garcia said.

The free software is for those making $72,000 or less, and according to Garcia “70 percent of all Americans qualify for free software.”

To get the free file software one needs to go to IRS.gov. “After clicking on the software you want, it will ask if you want to leave the IRS.gov website. Say ‘Yes’,” Garcia said

“You cannot search on Google and find this free software,” Garcia said.

What the IRS will and won’t do

Garcia explained in what ways the IRS will not contact taxpayers.

The IRS does not call, email, or text people and threaten them, according to Garcia.

“There are three things the IRS will not do: threaten, intimidate, or demand a particular payment method,” Garcia said.

“We are not going to threaten to kick you out of school, deport you or foreclose on your house.

“We are not going to ask you to buy YouTube cards to pay your bill,” Garcia said. “People get upset and they stop thinking. There are a lot of scammers out there.”

Garcia explained that the IRS will mainly contact taxpayers via mail (USPS).

“It is very rare, but we might call you if you have received a stack of notices, and you have just put them in a drawer,” Garcia said.

Michigan tax filing

Deputy Public Information Officer, Michigan Department of Treasury Ron Leix confirmed Michigan has also extended the 2020 tax filing date to May 17, 2021.

“It was done to make it easier for filers.

“There are 24 cities in Michigan with a city income tax. You need to contact the city directly to see if they have extended their deadline,” Leix said.

Leix also encouraged people that are getting a tax refund to not wait to file.